Our Services

Ancillary Revenue and International Business Development

TO ONLINE DISTRIBUTOR PARTNERS

TO PRODUCTS PROVIDERS

FEATURED ANCILLARY PRODUCTS TRAVEL AND TOURISM

FEATURED ANCILLARY PRODUCTS INSURANCE AND HEALTH

INTERNATIONAL BUSINESS DEVELOPMENT

Benefits:

TO ONLINE DISTRIBUTOR PARTNERS:

- Increased Online Take Rates/conversion Rates

- Increased Revenue

- Better Customer Satisfaction and Overall Online Journey

- Repeat Customers

TO PRODUCT PROVIDERS:

- Increased Market Share via New Distribution Channels

- Increased Sales Revenue

- Ability to Collect Upfront the Proceeds From the Sales

TO COMPANIES INTERESTED IN INTERNATIONAL BUSINESS DEVELOPMENT:

- Tailored International Market Research and Advising

- Specific Insights on International Trade and Market Expansions

About Optima Vidis:

We Bring Success because of our Expertise and our Belief that The Sky’s the Limit!

-

Our Legal Structure and History:

- Established in 2018

- Limited Liability Company, Formed in the USA

- Filled as a Foreign Limited Liability Company Within the USA

- Founded by Kristiyan D. Davidkov, MSIB, MSEE, MBA

Our Expertise:

Over 15 Years in the Travel Insurance and Ancillary Revenue Markets

Proven Business Model With Major:

- Airlines in the USA, UK, Ireland, Spain, and Australia (Legacy & Low-Cost Carriers)

- Online Travel Agencies (OTAs) in the USA

- Passenger Railroad Companies in the USA and EU

- Health Care Providers in the USA

Strategic Business Location in USA Close to Major World Airports

International Experience, Multiple Languages: Bulgarian, French, Russian, and English

US Insurance Licenses: Property & Casualty; Life, Annuities, and Health.

Due Diligence, Attention to Details, Tailored service

Optima Vidis

Our Advantages

Expertise in Ancillary Revenue and International Business

Good Market Awareness

Favorable Regulations (New Distribution Capability created by IATA)

Relatively Small Competition

Small-Size Tech Companies, Lacking:

- Proper Product Sourcing Capabilities

- International Reach

- Proper Insurance Licensing

In-house efforts by large eCommerce players, lacking:

- Focus Due to Their Other Online Priorities

- Experience With Small Prosduct Provider

Win-win-win - Universal Business Model:

Suggested Pay-per-Performance Pricing Model (as a Percentage of Sales):

- 70% - Product Provider

- 25% - Online Distributor Partner

- 5% - Optima Vidis

Long-term, End-Customer Oriented Strategy:

- More Valuable Product Choices

- More Satisfied Customers

- Better Online Journey Experience

Minimal Upfront Cost and Streamlined Implementations

Market Insights

Ancillary Revenue Research and

Analysis

Promising Ancillary Revenue Market:

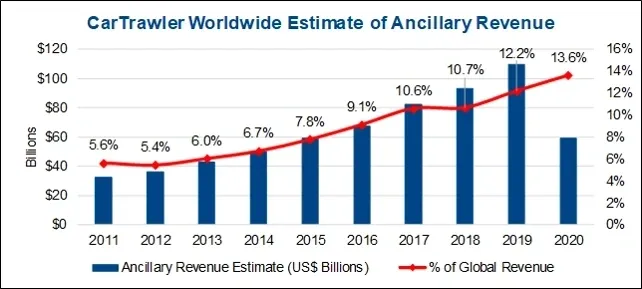

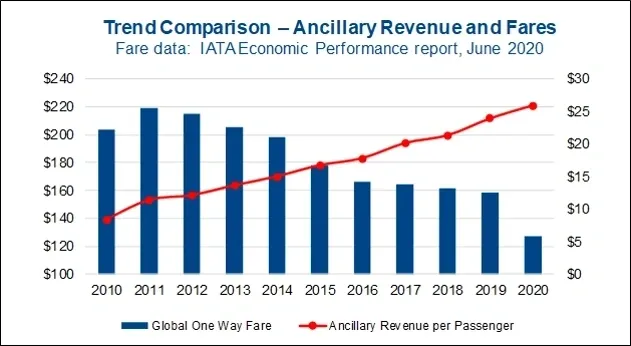

- 312 % Increase From 2010 to 2018: $23b to $93b

- Increases 51% for 61 Airlines in 2022

- Reached Approx. $118B in 2023

- Back in 2017, 58% of Airlines Placed Ancillary Revenue as One of Their Top 3 Priorities

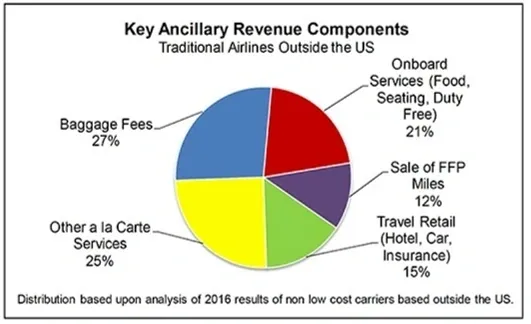

- Airlines Hold Approximately 67% of the Entire Ancillary Revenue Generated in 2018

- Ancillary Revenue is 12% of the Total Revenue for the Airline Industry (2019)

- Ancillary Revenue Now Makes for Half of the Airlines’ Annual Fuel Cost Bill

Even the COVID-19 Pandemic WAS NOT a Show Stopper (2020 VS. 2019)

Although the 2020 Airline Ancillary Revenue…

…Gross Dropped approx. 47% to $58B …

This Still represented a*…

11.5% Increase vs. 2019

as a % of Global Revenue (+143% vs. 2011)

8% Increase vs. 2019

as a Revenue per Passenger (+200% vs. 2010)

* Source: Cartrawler & IdeaWorks:

Data reported by 81 Airlines, but the study was applied to 134 Airlines for a truly global projection

- Ancillary Products Take Rates Examples- Apr to Jun 2020:

- (AirAsia – Malaysia & Thailand Operations)**

- 14% Trip Insurance – Up 88% From Pre-pandemic

- 47% Baggage – Up 72% From Pre-pandemic

- Pre-order Meals: 43% Higher Revenue Per Passenger

- 26% Assigned Seating – Up 15% From Pre-pandemic

** Source: Cartrawler

Achievements

Our Achievements